Not sure which office is closest to you? Try our Office Finder.

Keep up to date with the latest headlines and stories within Family Law and Divorce.

Published: 17th January 2024

A Solicitor at K J Smith’s Oxford office, Kate Evans shares her journey into law, her passion for supporting clients and what a typical day looks like as a family law solicitor.

Published: 14th December 2023

Christmas is a time for family, but for newly separated parents this takes on a whole new meaning. For parents who are in the process of separation, Christmas can conjure up feelings of dread, sadness and even guilt as they experience a new family dynamic. From coping with the changes to the family unit to finding new traditions and maintaining the magic, the first Christmas as a single parent can be extremely challenging.

Here, Sofie Corbin, Senior Chartered Legal Executive at K J Smith, offers her tips on how to navigate Christmas as a newly single parent and ways to ensure it goes as smoothly as possible.

Published: 29th November 2023

When Gwyneth Paltrow and Chris Martin announced they were ‘consciously uncoupling’ back in 2014, it was met with mockery from the media. Fast forward to 2023 and it appears amicable divorces are on the rise.

Published: 22nd September 2023

Lydia Anson, a paralegal at K J Smith’s Southampton office, talks us through her experience so far.

Published: 27th April 2020

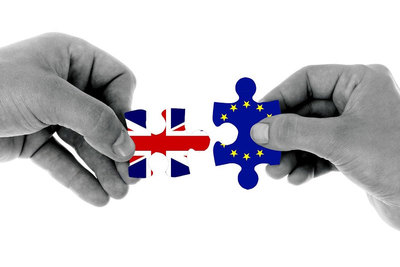

The UK has finally taken the steps to formally leave the EU, however with the world currently fighting a pandemic due to Covid-19, it’s easy to forget the elephant in the room.

Published: 31st March 2020

If you are a separated family, a pandemic and a nation-wide lockdown is the last thing anyone would wish for and many families may be wondering exactly how they spend time with their children and co-parent effectively, without causing unnecessary panic and stress.

Published: 16th March 2020

It’s been widely acknowledged that Brexit will have major implications for both the UK and Europe and so far, family law appears to have flown largely under the radar, but Brexit has the potential to lead to major changes in this area and they may not be at all welcomed.

Published: 25th February 2020

We look at the role technology and social media plays in domestic abuse and what you can do to protect yourself.

Published: 13th December 2019

Perhaps it is less true that relationships are changing and more true to say that people and the law are becoming more open about realities such as cohabitation, divorce, civil partnerships and the need for fostering and adoption.

Published: 19th September 2019

A divorce is often a very difficult time for everybody involved; however, when there are children involved, they have to be the main priority. Co-parenting is a must following your divorce, yet you may well have your reservations about doing so, based on several different factors.

Published: 17th September 2019

It's always wise to plan for every possibility in the future - otherwise, you could be left high-and-dry while the business you worked tirelessly to build is sold for next to nothing to satisfy your partner’s demands. We look at ways to protect your busniness assets in divorce.

Published: 16th September 2019

It is recognised that there are many forms of abuse and coercive control in addition to the signs of physical violence. We've put together a brief guide to the five key signs of domestic abuse in relationships.

All our offices are easily accessible by road, rail or bus and we are open Monday to Friday from 9:00am to 5:30pm.

Not sure which office is closest to you? Try our Office Finder.

If you would like to visit our team of family solicitors, we have offices in Henley-on-Thames (Head Office) Reading, Reading (Central), Basingstoke, Guildford, Beaconsfield, Ascot, Newbury & Winchester, St Albans, and Southampton. We serve a wide range of other areas including Abingdon, Bracknell, Gerrards Cross, Maidenhead, Marlow, Oxford, Slough, High Wycombe and Wokingham.

Why not contact our team of divorce solicitors for a free initial consultation today? We offer a free initial consultation that can take place in any one of our offices or over the telephone.

We are proud to have represented many excellent clients. Below are some comments our clients have made about us.

We are always looking for exceptional people to join our team.

Whether you are considering a move now or at some point in the future, we would love to hear from you and learn more about your career goals and motivations.

At K J Smith we pride ourselves on our commitment to offering support, guidance and career development across all roles. You will receive a competitive salary along with a comprehensive range of benefits.

Partner at our Ascot office

"I joined K J Smith with an open mind and with the expectation of developing and adding diversity and challenge to my career, having spent 23 years in a comfortable position with a traditional high street practice.

I can honestly say that K J Smith have exceeded my expectations. Since joining, I have felt supported and encouraged by the firm’s continued commitment to growth and improvement. The company allow staff at all levels to have a voice and recognise the importance of investment in their employees at every level."